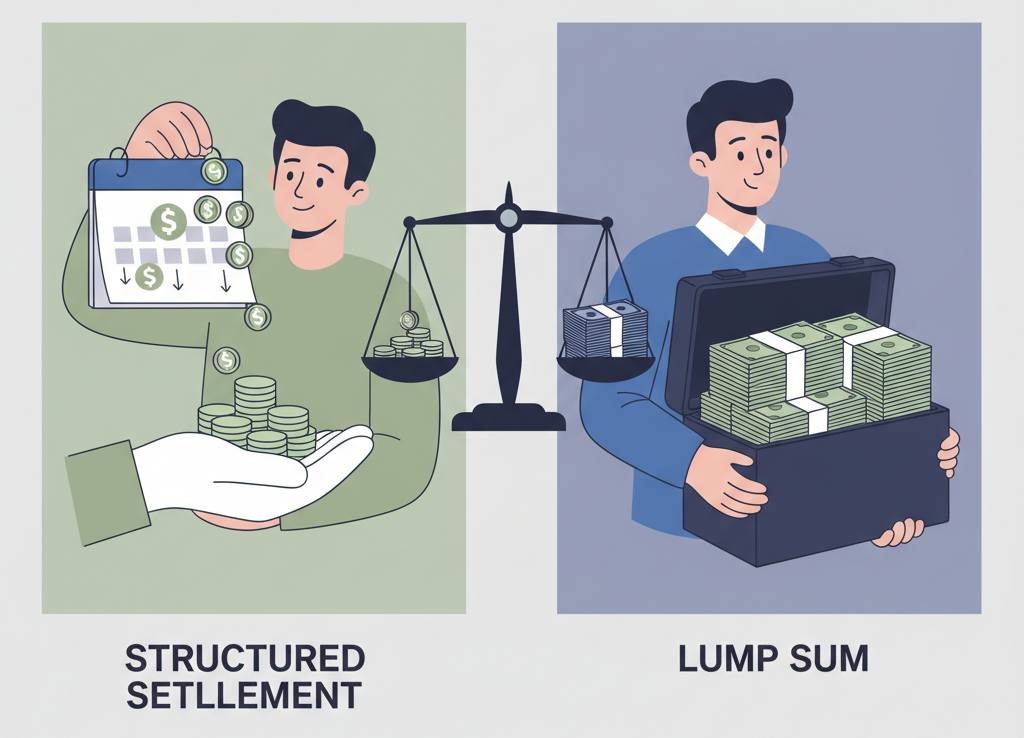

When individuals win a legal case or receive compensation for personal injury, they often face a crucial financial decision: structured settlements vs lump sum payments. Both options have advantages and disadvantages, and the right choice depends on your financial needs, goals, and risk tolerance.

In 2025, with rising living costs and evolving investment opportunities, choosing between structured settlements and lump sums has become even more important. This article explores how each option works, their pros and cons, tax implications, and how to decide which one may be the best fit for you.

What is a Structured Settlement?

A structured settlement provides compensation in periodic payments spread over months or years. This method ensures financial security and helps recipients avoid spending all their money too quickly.

Pros:

- Long-term financial stability

- Often tax-free for personal injury cases

- Protection against poor spending habits

Cons:

- Limited flexibility

- Cannot easily access full value at once

- Requires court approval to sell payments

What is a Lump Sum Payment?

A lump sum payment gives recipients all their compensation at once. This option offers full control but also carries risks if not managed wisely.

Pros:

- Immediate access to full amount

- Flexibility for big purchases or investments

- Ability to settle debts quickly

Cons:

- Higher risk of overspending

- May have tax implications

- No long-term guaranteed income

Tax Considerations in 2025

- Structured Settlements: Usually tax-free for personal injury. Payments are predictable and secure.

- Lump Sum Payments: May be subject to taxation depending on the case type. Poor planning could lead to unnecessary IRS penalties.

When Should You Choose a Structured Settlement?

- If you value consistent income

- If you are not confident in managing large sums

- If your primary goal is long-term stability

When Should You Choose a Lump Sum Payment?

- If you need immediate cash for debts or medical expenses

- If you want to invest in opportunities that may yield higher returns

- If you are financially disciplined and have expert guidance

Real-Life Example

Imagine a settlement worth $500,000. With a structured settlement, you may receive $25,000 annually for 20 years. With a lump sum, you receive the full $500,000 immediately. While the lump sum offers freedom, it also places the responsibility of financial management solely on your shoulders.

Key Decision Factors in 2025

- Financial Needs – Urgent vs. long-term stability

- Investment Knowledge – Ability to grow lump sum wisely

- Health & Age – Younger recipients may prefer lump sums for investments

- Inflation – Lump sums may lose value slower if invested properly

The choice between structured settlements and lump sum payments is highly personal. In 2025, economic conditions make this decision even more significant. Structured settlements remain a safe and stable option, while lump sums provide freedom but require discipline and planning.

The best decision depends on your circumstances, goals, and ability to manage money responsibly. Before choosing, consult with both a financial advisor and a legal professional to make sure you are maximizing your settlement’s value.