Safety is one of the first concerns for any investor. Stocks can rise and fall overnight, real estate depends on market cycles, and even government bonds carry inflation risks. But what about structured settlement investments?

In 2025, more individuals and institutions are exploring this alternative asset class. They want to know: Are structured settlement investments truly safe? This article provides expert insights into the legal protections, risks, and overall security of structured settlements.

📌 Understanding Structured Settlements

A structured settlement is a financial arrangement where someone receives regular payments after winning a lawsuit, typically for personal injury or wrongful death.

Insurance companies usually fund these settlements with annuities. Later, investors may purchase the rights to these payments at a discount, gaining steady income over time.

Because they are backed by major insurers and approved by courts, structured settlements often carry a reputation for safety and reliability.

📌 Why Structured Settlement Investments Are Considered Safe

1. Court Approval

Every structured settlement sale requires judicial approval. Judges review the deal to ensure fairness, preventing predatory practices. This process protects both sellers and buyers.

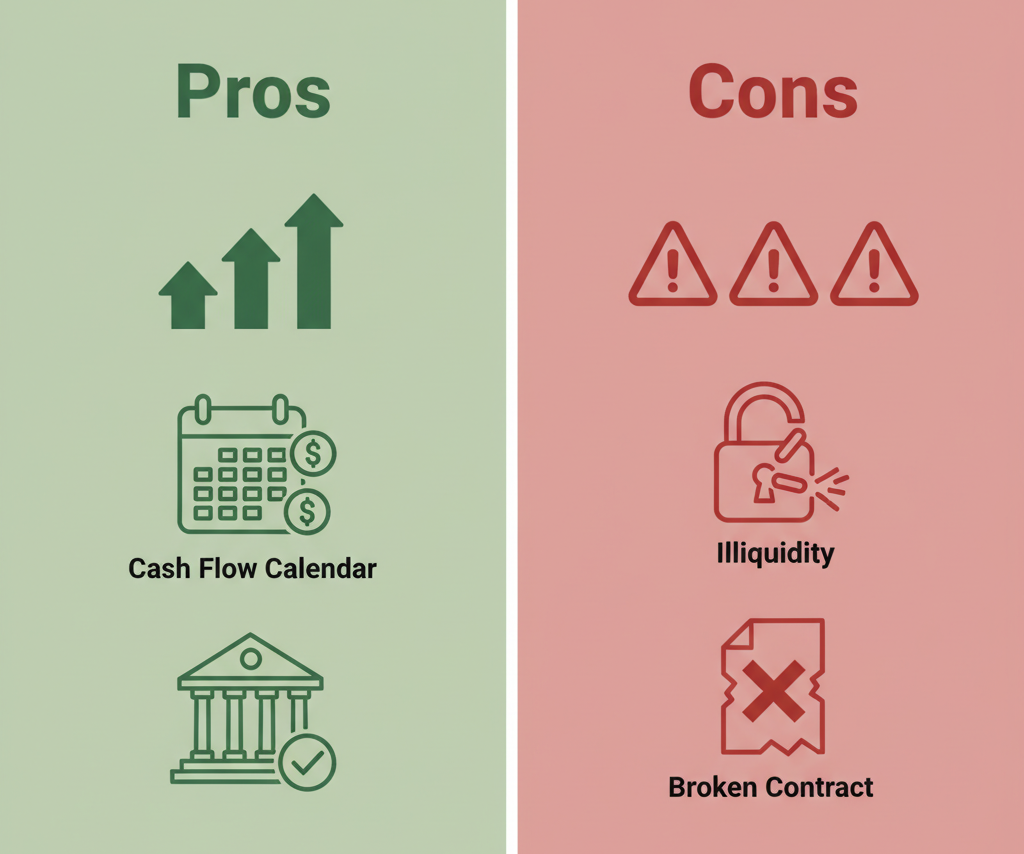

2. Insurance Company Backing

Payments come from large insurance providers. Many of these insurers have strong credit ratings, meaning they have the financial strength to make payments for decades.

3. Predictable Cash Flow

Unlike stocks or mutual funds, structured settlements provide a fixed schedule of payments. Investors know exactly how much and when they will receive money.

4. Low Market Correlation

Settlement payments are not tied to stock market performance. Even during economic downturns, they generally continue without interruption.

📌 Risks You Need to Know

Despite strong safeguards, no investment is risk-free. Structured settlements also come with potential risks:

- Credit Risk: If the insurance company faces financial trouble, payment delays could occur.

- Liquidity Risk: These investments are not easily resold. Once you commit, your money is tied up.

- Legal Complexity: Improper documentation or unreliable brokers may create legal disputes.

- Fraud Risk: Fake buyers or sellers sometimes operate in this niche.

However, most of these risks can be minimized with proper due diligence and trusted legal support.

📌 Expert Insights on Safety (2025)

Industry experts emphasize that safety depends on the source:

- Reputable insurance providers with high credit ratings increase reliability.

- Licensed brokers reduce fraud risks.

- Court approval ensures the transfer is legitimate and enforceable.

According to financial analysts, structured settlement investments in 2025 are safer than many high-yield alternatives, but they should still be part of a diversified portfolio.

📌 Best Practices to Stay Safe

- Research the Insurer

Always check the insurance company’s credit rating through agencies like A.M. Best or Moody’s. - Verify Court Approval

Never invest in a settlement that has not been approved by a judge. - Use Licensed Brokers

Work only with professionals who hold proper certifications. - Review Contracts Carefully

Hire an attorney to review all legal documents before signing. - Diversify Your Portfolio

Avoid putting all your money into settlements. Balance them with other assets.

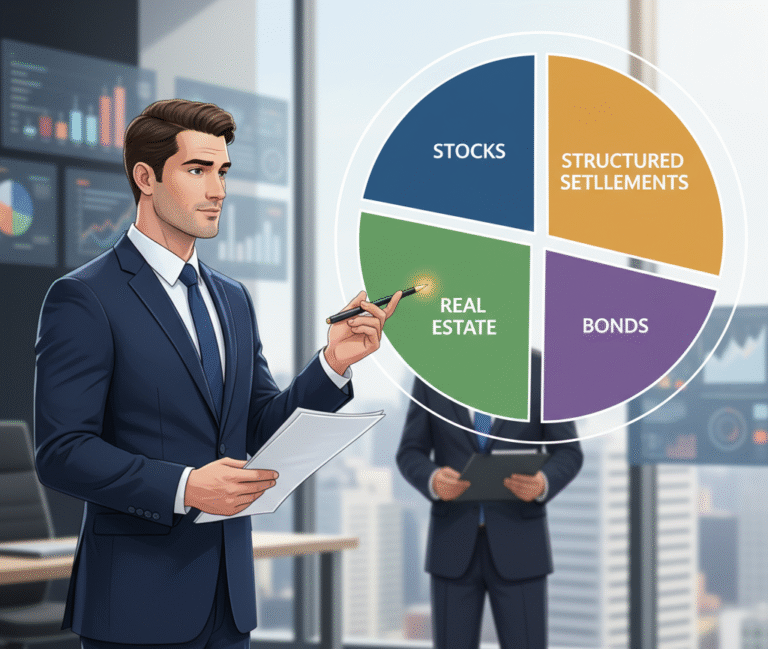

📌 Comparing Safety With Other Investments

- Stocks: Higher growth potential, but volatile.

- Bonds: Stable, but sensitive to interest rate changes.

- Real Estate: Tangible, but depends on economic cycles.

- Structured Settlements: Predictable payments, court oversight, and insurer backing.

As a result, structured settlements fall somewhere between bonds and annuities in terms of safety and predictability.

📌 Conclusion

So, are structured settlement investments safe? The answer is yes, but with conditions. Their safety comes from court approval, insurance company backing, and predictable income streams. Risks exist—particularly liquidity and credit risks—but they are manageable with proper research and legal review.

In 2025, structured settlements stand as a secure and reliable alternative investment. When used wisely and as part of a diversified strategy, they offer peace of mind along with financial stability.