Why Investors Are Turning to Structured Settlements in 2025

Investing in structured settlements has grown increasingly popular in the United States, particularly as economic uncertainty continues to rise in 2025. Stock markets remain volatile, inflation concerns are high, and traditional savings accounts offer low returns compared to the past. In this environment, many investors are searching for safer, more predictable options that can provide stable income.

Structured settlements have become one such alternative. Unlike high-risk speculative investments, structured settlements offer steady payments that are usually backed by large insurance companies. However, while these investments appear safe, they come with their own set of challenges. Before jumping in, it’s essential to evaluate whether structured settlements are truly the right fit for your financial goals.

This article breaks down what structured settlements are, the rewards they offer, the risks you must consider, and how they compare to other investments in 2025.

What Are Structured Settlements?

A structured settlement is a financial arrangement in which a person receives periodic payments, typically after a lawsuit settlement such as a personal injury case. Instead of getting one large lump sum, the claimant receives smaller payments over time—monthly, quarterly, or annually—depending on the agreement.

For investors, structured settlements are usually purchased from individuals who no longer want to wait for their scheduled payments. These individuals often sell their settlement to get an immediate lump sum of cash, and in return, the investor (or a settlement purchasing company) collects the remaining future payments.

Structured settlements are often backed by annuities provided by insurance companies, which adds a layer of reliability compared to other alternative investments.

>>What Is a Structured Settlement?

Why People Consider Investing in Structured Settlements

There are several reasons why structured settlements attract investors in 2025:

- Steady and Predictable Income: Payments arrive on a fixed schedule, similar to receiving rent or bond interest.

- Diversification: They provide an alternative to stock market volatility.

- Attractive Yields: In some cases, structured settlements may offer higher returns than government bonds or savings accounts.

- Security: Because many settlements are guaranteed by established insurers, investors may see them as safer than speculative investments.

In a time when financial stability is a top concern, these features make structured settlements especially appealing.

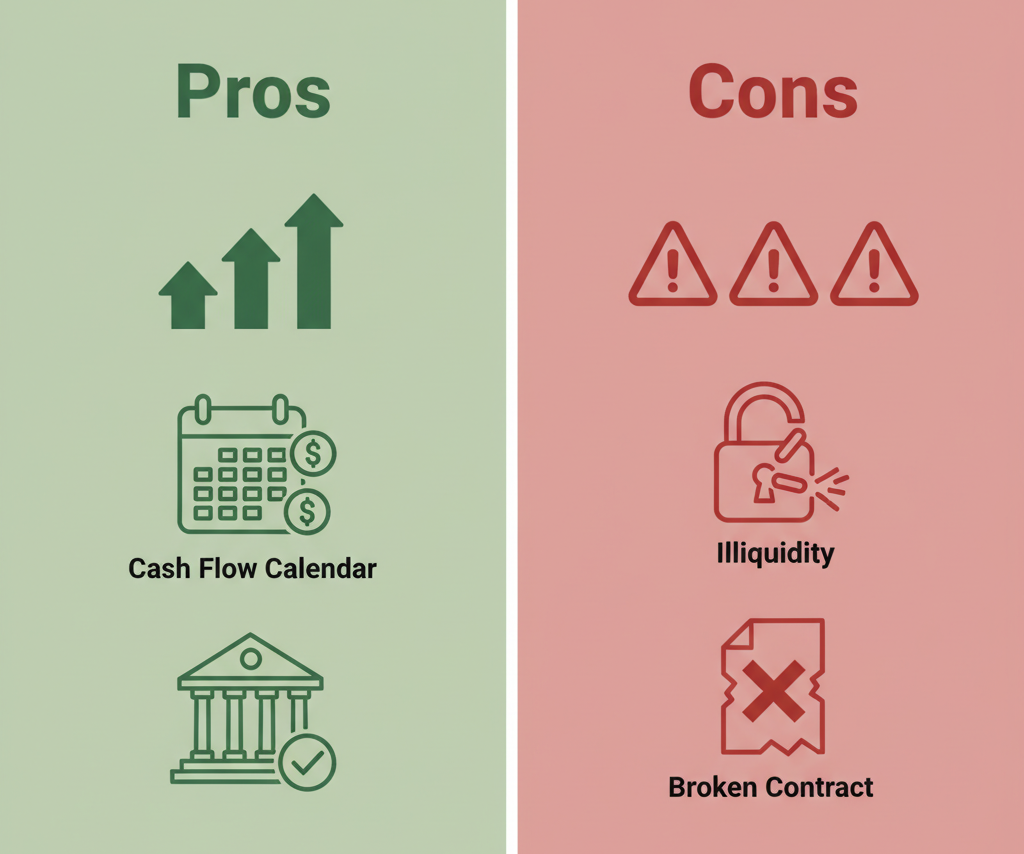

The Rewards of Structured Settlement Investments

Like all investments, structured settlements come with upsides. Here are the key rewards:

1. Predictable Income

Investors receive payments on a fixed schedule, which is ideal for retirees or those who need a steady stream of income.

2. Higher Returns Compared to Traditional Savings

In 2025, interest rates on savings accounts remain relatively low, while structured settlements can provide higher effective yields.

3. Long-Term Stability

Since settlements are usually backed by insurance companies, they provide more confidence compared to risky investments.

4. Tax Benefits

Some structured settlement payments are tax-free for the original recipient, and depending on the structure, investors may also enjoy certain tax advantages.

The Risks of Structured Settlement Investments

Despite their benefits, structured settlement investments are not risk-free. Here are the major risks to consider:

1. Limited Liquidity

Once you purchase a structured settlement, you are essentially locked in. Unlike stocks or bonds, you can’t easily sell your investment to get cash quickly.

2. Inflation Risk

Payments are fixed. Over time, inflation reduces their real value. A $1,000 monthly payment today will not carry the same purchasing power ten years from now.

3. Legal and Regulatory Risks

Structured settlement sales must be approved by courts, and laws can vary by state. Changing regulations in 2025 may also affect the resale or taxation of these investments.

4. Insurance Company Risk

If the insurance company that issued the annuity runs into financial trouble, investors could face delays or reduced payments.

Structured Settlements vs. Other Investments in 2025

When deciding whether structured settlements are the right fit, it’s important to compare them to other common investment options:

- Stocks: Offer higher potential returns but are extremely volatile. Structured settlements are much more stable but with lower growth potential.

- Bonds: Both bonds and structured settlements provide predictable income. However, structured settlements may yield more but are harder to resell.

- Real Estate: Provides potential appreciation and rental income but requires active management and comes with property risks. Structured settlements require no management but lack appreciation.

- Certificates of Deposit (CDs): Low-risk but typically very low return. Structured settlements may offer a better balance between safety and income.

Who Should Consider Structured Settlement Investments in 2025?

Structured settlements are not for everyone. They may be a good fit for:

- Retirees who need steady, predictable monthly income.

- Conservative investors who want less exposure to stock market volatility.

- Investors seeking diversification with an alternative income source.

- Individuals who value stability over high-risk, high-reward opportunities.

However, those who may need quick access to their money—or those who want more flexible investments—should be cautious.

Practical Tips for Safe Investing in 2025

If you decide to pursue structured settlement investments, keep these tips in mind:

- Work With Reputable Companies: Only buy from trusted firms with strong track records.

- Verify Court Approval: Ensure the settlement transfer has been legally approved.

- Understand the Discount Rate: Small differences in rates can significantly affect your return.

- Consult Legal and Tax Experts: Professional advice can save you from costly mistakes.

- Consider Inflation-Protected Alternatives: Balance your portfolio to offset inflation risks.

Final Thoughts: Is It Safe?

So, is investing in structured settlements safe in 2025? The answer depends on your financial goals. Structured settlements are generally safer than stocks but less flexible than bonds. They can provide steady income and stability, but they lack liquidity and carry inflation risks.

For conservative investors who value predictable payments and security, structured settlements can be a smart niche investment. However, for those seeking growth or flexibility, they should only be a small part of a diversified portfolio.

In short: structured settlements can be safe if approached carefully, but they are not a one-size-fits-all solution.