When individuals receive compensation from a lawsuit, personal injury claim, or insurance settlement, they often face a crucial decision: should they take the money as a lump sum or as structured settlement annuities? The latter option provides guaranteed payments over time, offering financial stability and tax advantages. In this guide, we’ll explore what structured settlement annuities are, how they work, and why they may be the right choice for your financial future.

What Are Structured Settlement Annuities?

Structured settlement annuities are financial agreements designed to provide recipients with periodic payments instead of a single lump-sum payout. These payments are funded through an annuity purchased from a life insurance company, ensuring consistent income over months, years, or even decades.

- Structured means that payments follow a predetermined schedule.

- Settlement refers to compensation awarded, often from lawsuits or claims.

- Annuity is the financial product that guarantees those payments.

In simple terms, the defendant (or their insurer) funds an annuity that ensures you receive secure, tax-advantaged payments for the long term.

How Do Structured Settlement Annuities Work?

The process typically follows these steps:

- Settlement Agreement – A lawsuit or insurance claim results in financial compensation.

- Payment Choice – The recipient chooses between a lump sum or structured payments.

- Annuity Purchase – The defendant or insurer buys an annuity policy from a life insurance company.

- Guaranteed Payments – The annuity pays the recipient on a set schedule (monthly, annually, or custom).

Unlike lump sums, annuities ensure long-term financial protection, especially for individuals who may not be experienced in managing large amounts of money.

Key Features of Structured Settlement Annuities

1. Guaranteed Income Stream

Payments are fixed and reliable, which helps individuals budget and plan effectively.

2. Tax Benefits

Structured settlement annuities are usually tax-free when related to personal injury or wrongful death claims.

3. Customization

Payment schedules can be tailored—monthly, quarterly, annually, or in larger installments for major expenses (like college tuition or medical bills).

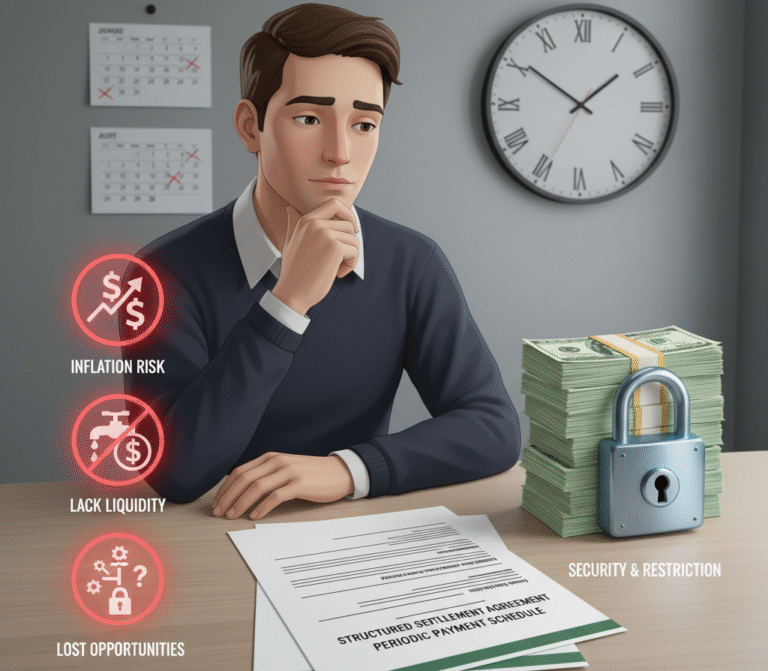

4. Security & Protection

Funds are managed by established insurance companies, reducing the risk of financial mismanagement.

5. No Market Risk

Unlike stocks or bonds, annuities are not tied to market performance, ensuring predictable payments.

Advantages of Structured Settlement Annuities

- Financial Discipline: Prevents quick spending of a lump sum.

- Stability for Families: Especially useful for minors or individuals with long-term care needs.

- Lifetime Security: Some annuities can last for the recipient’s entire life.

- Protection Against Creditors: In many cases, annuity payments are shielded from bankruptcy claims.

Potential Drawbacks

While beneficial, annuities are not perfect:

- Limited Flexibility: Once the payment schedule is set, it cannot easily be changed.

- Inflation Concerns: Fixed payments may lose value over time unless inflation protection is included.

- Liquidity Issues: Access to large sums is restricted unless the annuity is sold (secondary market).

Who Should Consider Structured Settlement Annuities?

Structured settlement annuities are ideal for:

- Injury victims who need stable, lifelong payments.

- Families with children needing future educational or healthcare funding.

- Individuals without investment experience, who prefer guaranteed income.

- Anyone worried about overspending a lump sum too quickly.

Example Scenario

Imagine John receives a $1 million settlement from a personal injury case. Instead of taking it all at once, he chooses a structured settlement annuity that pays:

- $3,000 per month for living expenses

- $25,000 every 5 years for major expenses

- Lifetime benefits for healthcare coverage

This way, John secures his financial future without worrying about running out of money.

Structured settlement annuities provide a safe, tax-advantaged, and reliable income stream. While they may not offer the same flexibility as a lump sum, they ensure long-term financial security, especially for individuals who value stability over risk.

As 2025 progresses, structured settlement annuities continue to be one of the most trusted tools for financial planning after a legal settlement.

👉 Whether you’re deciding between a lump sum and an annuity, consulting with a financial advisor or structured settlement company can help you choose the option best suited to your needs.