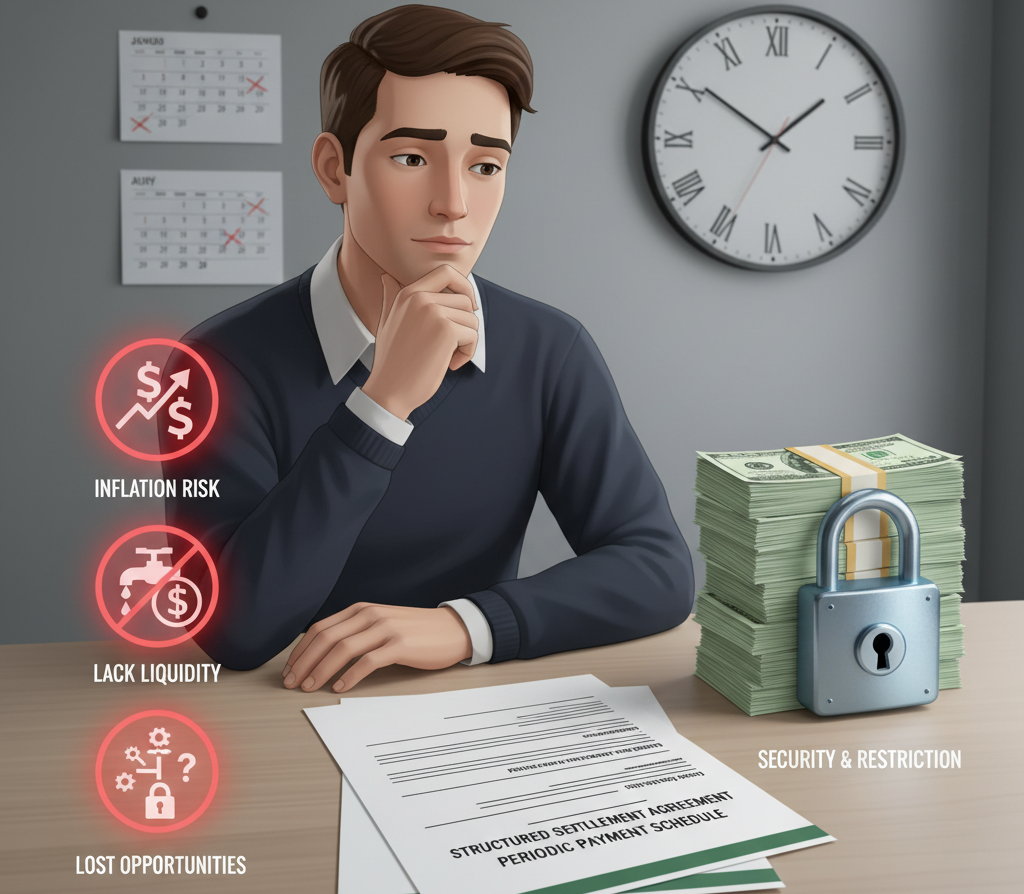

Structured settlement annuities are widely praised for stability and long-term financial security. However, like any financial product, they are not perfect. In 2025, individuals considering annuities must carefully weigh the risks and limitations before making a decision.

This article explores the downsides of structured settlement annuities to help recipients understand where potential challenges may arise.

1. Lack of Liquidity

One of the biggest drawbacks is limited access to cash. Once a settlement is structured, recipients cannot easily withdraw lump sums when unexpected expenses occur.

👉 Example: If medical bills suddenly rise, the fixed monthly payments may not be enough.

2. Inflation Concerns

While some annuities include inflation protection, many do not. Over time, the real value of payments may decline if living costs rise faster than the payment schedule.

✅ $2,000 monthly may cover expenses today.

❌ But in 10 years, it might not be sufficient.

3. Limited Flexibility

Structured settlements are designed for stability, not flexibility. Once terms are set, they are difficult to change. Recipients cannot renegotiate payment structures unless they sell their annuity, which often comes at a discount.

4. Dependence on Insurance Company Stability

Structured settlement annuities are backed by insurance companies. If the provider faces financial issues, recipients may experience risks, though state guaranty funds provide some protection.

5. Opportunity Costs

By receiving fixed payments, recipients miss out on potential investment opportunities. For example, money tied in an annuity cannot be invested in stocks, real estate, or businesses that might yield higher returns.

6. Selling Limitations

Although recipients can sell structured settlements to buyers, the process comes with drawbacks:

- Court approval is required.

- Payments are sold at a discount, meaning recipients often receive less than the total value.

- Risk of encountering scams in the resale market.

7. Not Suitable for Everyone

Structured settlement annuities are ideal for people who value security and predictability. However, for individuals with entrepreneurial goals, high medical expenses, or those who need immediate cash, they may not be the right choice.

While structured settlement annuities provide undeniable security and tax advantages, they also come with limitations such as lack of liquidity, inflation risks, and opportunity costs. Understanding these drawbacks is essential before committing to this financial arrangement.

👉 For anyone considering a structured settlement annuity in 2025, balancing the benefits vs. risks is the key to making a smart decision.