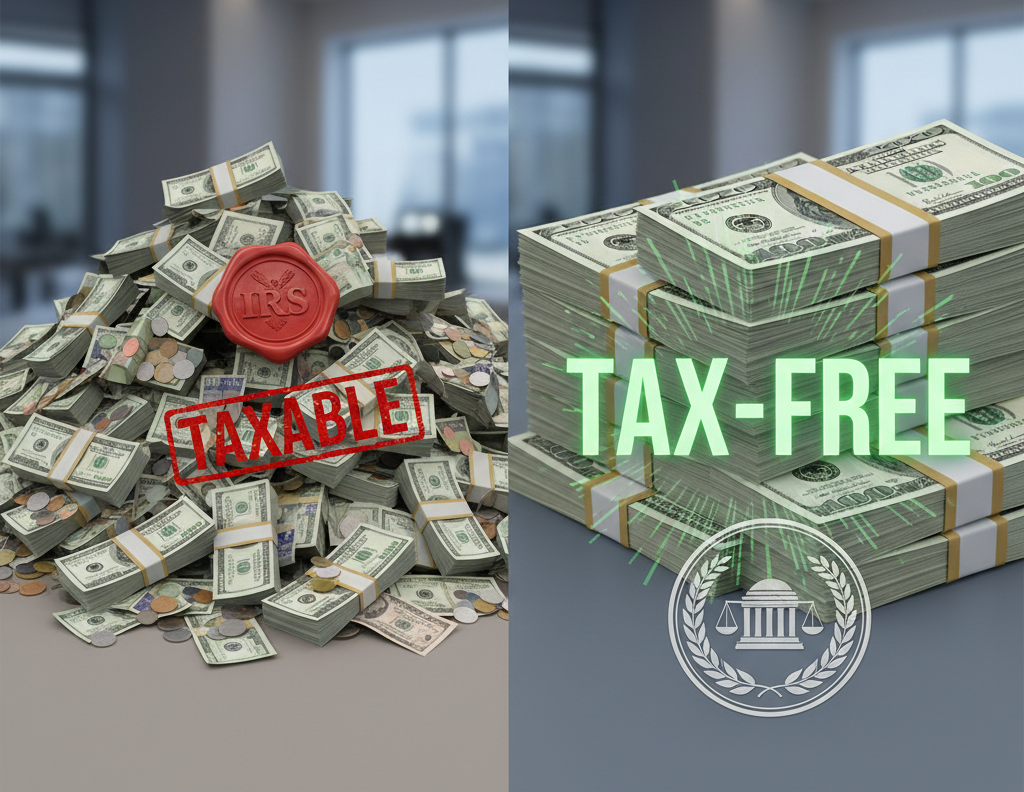

One of the most common questions people ask is: “Are structured settlements tax-free?” The answer isn’t always simple. While many structured settlements are exempt from federal and state income taxes, certain exceptions exist.

This article breaks down the rules in 2025, showing when settlements are tax-free and when they aren’t.

Tax-Free Scenarios

- Compensatory Damages: Payments for physical injury, sickness, or wrongful death are generally tax-exempt.

- Workers’ Compensation: Settlements for job-related injuries are usually tax-free.

- Medical Expenses: Payments covering medical bills often remain tax-exempt.

Taxable Scenarios

- Punitive Damages: Always taxable under IRS rules.

- Emotional Distress (without injury): Taxable unless tied to physical harm.

- Interest Earnings: If a settlement includes accrued interest, it is taxable.

Selling and Taxes

When selling structured settlements:

- The lump sum may be taxable.

- Buyers sometimes structure deals to minimize tax burden.

- Court approval ensures transparency but does not guarantee tax exemption.

State-Level Differences

Some states follow IRS rules strictly, while others apply additional taxes. Residents must check local laws.

So, are structured settlements tax-free? The answer depends on the type of damages and whether the recipient sells the settlement. In most personal injury cases, yes—but exceptions matter.